April brings big change

The Department of Health and Social Care (DHSC) is busy preparing the NHS for the switch to the IFRS accounting standard on 1 April. Initially scheduled to land a year ago but delayed for COVID-19, the NHS will soon be joining public listed corporates in applying this new accounting standard to their £100+ billion annual budget.

Included in the new standard is IFRS16, which will require each NHS Trust to account for their leased assets as Capital Budget items, or “on balance sheet.” This is a big departure from being simply able to tap into the Resource Budget to pay for those assets as operating expenses.

The DHSC appears to be casting a wide net too. The accounting policy choice to retrospectively restate in accordance with IAS 8 has been withdrawn, which means all existing leased assets will be impacted too, not just new assets going forward. Every leased asset currently in situ, therefore, needs to be identified and valued, and this includes the plethora of assets that are embedded within the NHS Trusts’ large and complex PFI and MES arrangements.

It’s not just the big assets either. DHSC guidance indicates that even IT assets, which would normally fall within the permitted £5000 exemption, will need to be aggregated to a total value and treated as Capital spend. Likewise, any small value assets going in as part of any refurbishment or ward enhancement.

Questions on the ground

For an asset-intensive organisation, this will have a massive impact on the way the NHS Trusts’ Procurement teams go about paying for new assets from 1 April.

Their Finance and Treasury teams will also be having to rethink what this means for their budgeting and annual report.

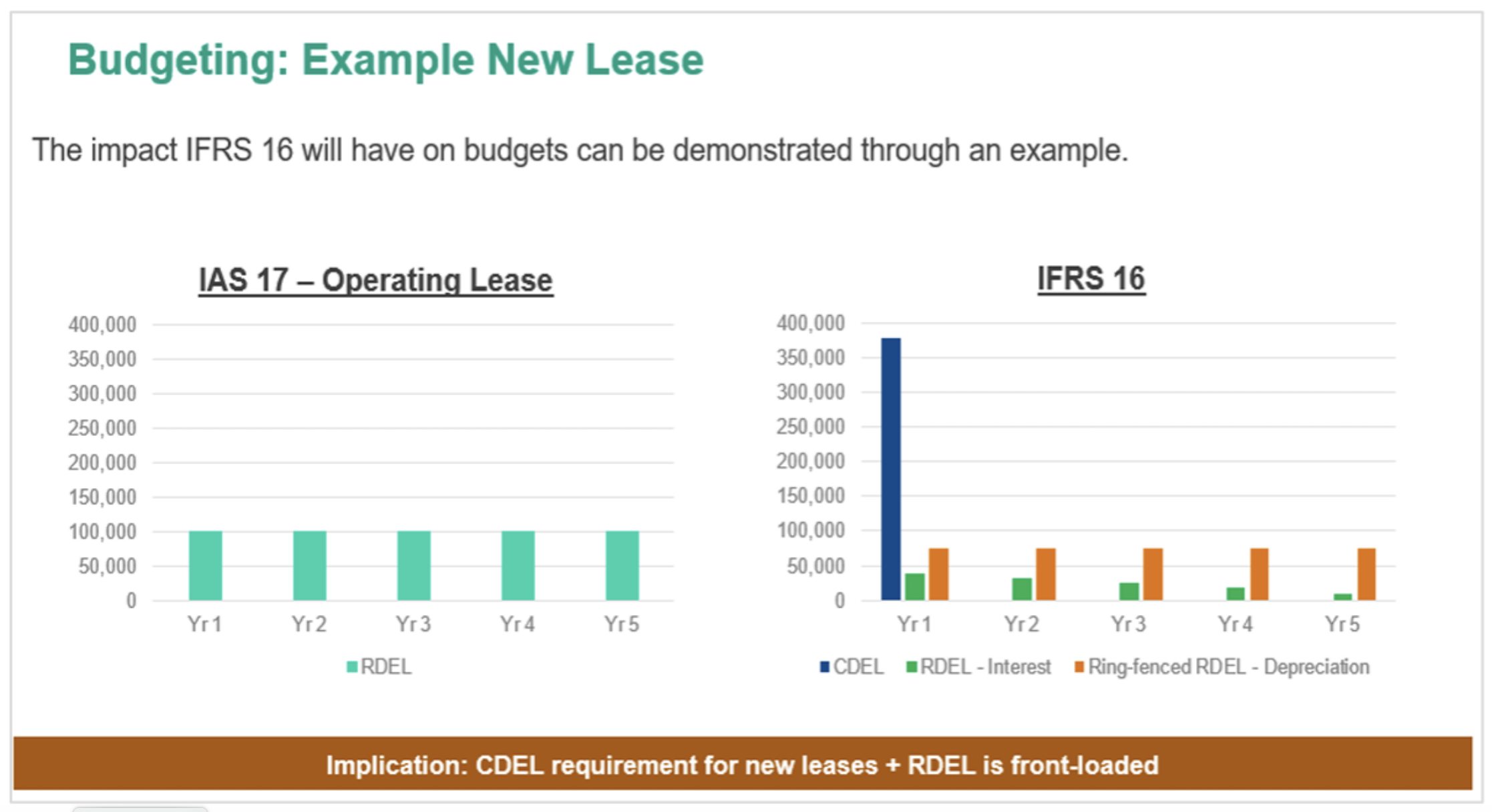

Here is an example of what the new standards will mean at a budgetary level.

We solve for IFRS and then go one better

Here at Falcon, we have created a highly innovative Asset-as-a-Service product that can allow NHS Trusts to continue paying for their assets using their Resource Budget, as an alternative to paying for leased or owned assets out of their Capital Budget. By using our product, we believe NHS Trusts should be able to continue to procure and account for their assets much the same way as they used to before IFRS.

We haven’t just stopped there. We’ve gone one step further to think about how we can make it even better for the NHS Trusts than before. A glaring problem in the past has been how to reconcile fixed lease payments against a fluid and fluctuating patient base. For example, even though NHS Trusts have had to delay non-urgent care over the past two years in the battle against COVID-19, they have still had to keep paying fixed lease payments for the associated assets that have laid dormant and unused.

Our Asset-as-a-Service product completely solves this problem for the NHS Trusts. It’s highly flexible and aligns asset payments to asset use. Replacing fixed payments with variable payments means the NHS Trusts only need to pay for the assets as and when they are actually using them for patients. We believe the payment-to-patient alignment is exactly what NHS Trusts need today and will serve as a powerful tool in their mission to balance their budgets.

There is a big opportunity right now, and Falcon is busy helping OEMs and healthcare providers get access to better asset solutions.

This article has been prepared solely for information purposes and the opinions expressed and set out herein are illustrative only. Please note that any content in this article regarding accounting treatment is based upon Falcon’s own views and opinions and should not be relied upon by the reader as accounting advice. Accounting treatment may vary on a case by case and therefore the reader should seek their own independent advice. Falcon shall not be liable for losses arising out of reliance on this article.