Helping Tier One Suppliers meet OEM demand without the pitfalls of trapped capital

In an ideal world, original equipment manufacturers (OEMs) would have a clear idea of future demand and advise their suppliers accordingly.

At the beginning of each month, Tier One suppliers would be given a plan and a weekly schedule, which is in turn communicated to Tier Two and Three Suppliers and beyond. Everyone in the supply chain would know exactly what and when they need to produce, ranging from basic components to the latest technology.

Of course, the reality is that accurately predicting demand can be challenging, and, even if this were not the case, supply chain disruption seems to be getting worse, not better. The plan starts to change as soon as it is issued, and parts are required much earlier than scheduled. Suppliers need to adapt quickly, and those that cannot fail in their delivery. Sales forecasts are then adjusted, which in turn impacts production orders, and the schedule has to be changed again. The vicious cycle continues.

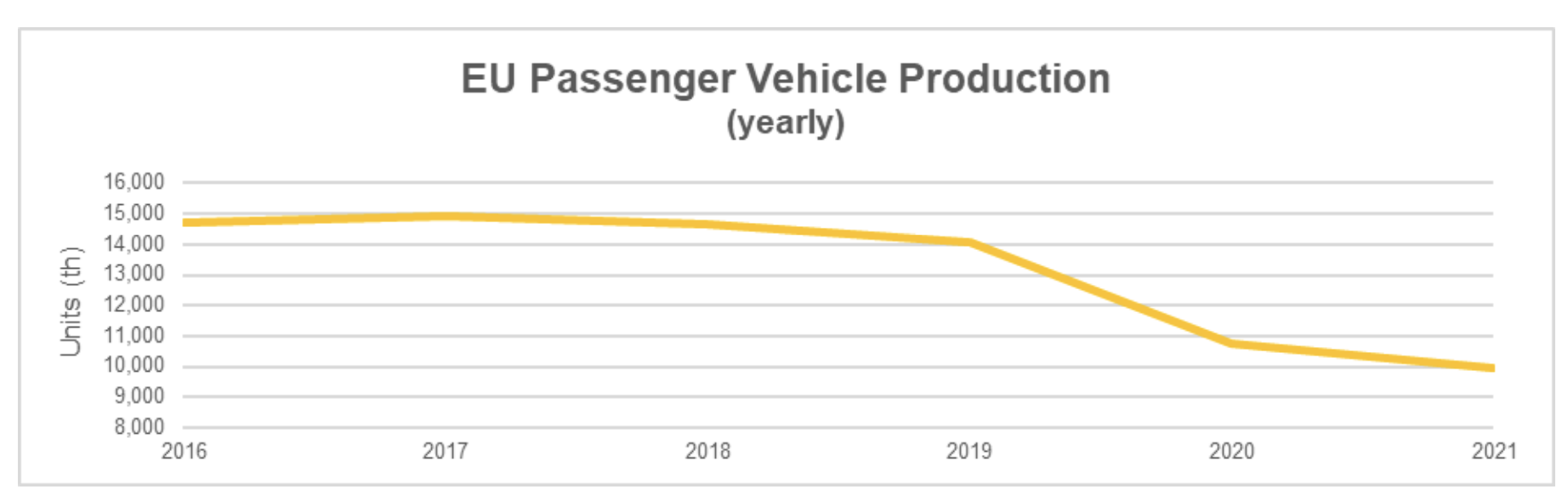

This is particularly the case for the automotive sector, with a typical vehicle containing anything between 15,000 and 25,000 components. The absence of a single critical component can impede or halt production completely, proving the adage that a supply chain is only as strong as its weakest link. This is particularly so for electronics and sensors, where there can be major downstream implications if there is any upstream disruption. The semiconductor shortage has certainly been felt acutely, with estimates of 8 million cars cut from global production between 2021 and 2023.

This vulnerability is exacerbated by the diverse sourcing of critical parts, both in terms of international supply chains and the prevalence of multiple tiers. This is a far cry from the vertically integrated approach that saw Model T Fords built from scratch at the same assembly plant. Nowadays, it’s true that large Tier One suppliers often locate their production facilities close to vehicle assembly and manufacturing facilities. However, there are typically multiple tiers of smaller suppliers below this top tier, each playing a critical role in the journey from raw materials to the finished product.

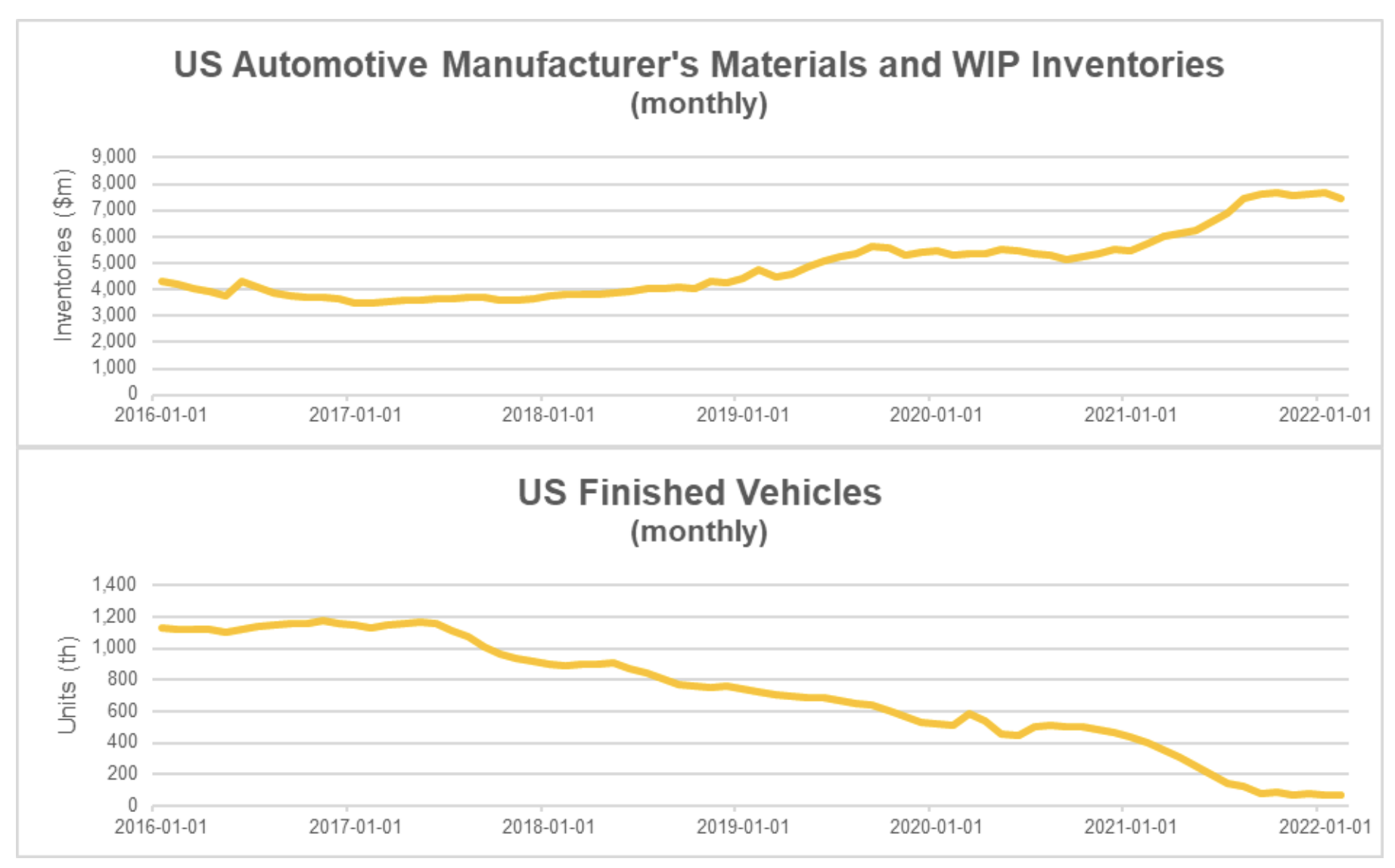

The fact is that OEMs demand reliable delivery. Unreliable providers are punished, with Tier One suppliers first in the firing line. Although there are moves for closer collaboration between OEMs and suppliers, often the only realistic option for the latter is to maintain large inventories of buffer stock. Indeed, this is something that OEMs are insisting on. The problem is that stockpiling inventory ties up capital which could be better used elsewhere, creating a high Days Inventory Outstanding number and a slow Cash Conversion Cycle. Ageing or obsolescent inventory can result in significant losses when demand falls abruptly. The good news for Tier One suppliers is that there is an alternative solution in plain view. Falcon Group is a specialist company which can help businesses address this challenge, buying new inventory, storing it in the customer’s own warehouse and then making it available when required on a Just In Time basis. In this way, inventory-trapped capital is set free, supply chain vulnerability is mitigated and fluctuating demands of OEMs can be met. The best of both worlds can be achieved. Contact Falcon to learn more about our inventory working capital solutions tailored for the automotive sector.