Since its inception 40 years ago, supply chain finance (“SCF”) has enjoyed remarkable success as a key facilitator of global trade, boosting working capital efficiency and unlocking liquidity.

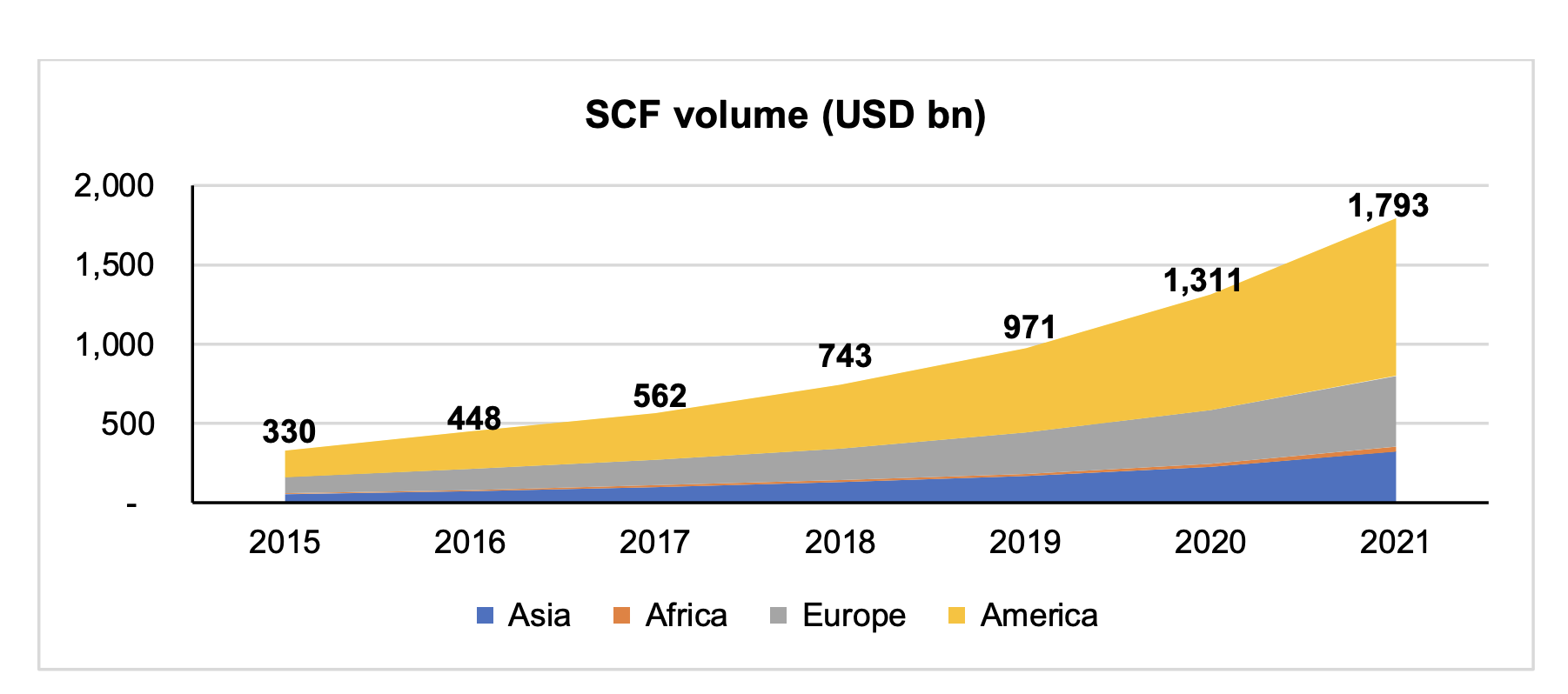

In a testament to how hungry markets have been for cash and overall efficiency, between 2015 and 2021, SCF volumes increased more than fivefold from $330bn to $1.8 trillion.

Why has SCF been so successful? The answer lies in its accounting treatment as non-debt and off-balance sheet. This has allowed companies using SCF programs to access cheap liquidity without affecting other financial metrics. This compares favourably to more traditional working capital optimization strategies like debt or factoring, which come at the price of increasing leverage for the end user.

Is the SCF party over?

Increased regulatory scrutiny could mean SCF loses its lustre. Echoing the 2019 introduction of operating lease disclosure requirements by the International Accounting Standards Board (“IASB”), in December 2021, the Financial Accounting Standard Board (“FASB”) and IASB proposed to make SCF program disclosures mandatory.

While increased scrutiny can drive transparency, the latest proposal could also deprive companies of a key means of improving working capital efficiency. Given that both regulators and ratings agencies have made it clear these proposals do not go far enough, it seems only a matter of time before SCF programs follow operating leases down the road to debt categorization.

The Way Forward: Third Party Inventory Ownership

Falcon proposes a solution that represents the future of supply chain programs: third party inventory ownership. Simply put, Falcon purchases inventory from suppliers, holds it, and provides it to buyers on a just-in-time (“JIT”) basis. In doing so, third party inventory ownership brings benefits beyond those offered by traditional trade finance and SCF programs. Unlike the SCF program, which kicks in only after an invoice has been issued, Falcon’s third-party inventory ownership model starts from the get-go. Because Falcon pays suppliers on sight and only sells to buyers on a JIT basis, suppliers obtain the immediate benefit of upfront revenue and cash recognition while buyers keep inventory off their balance sheets throughout transit and warehousing.

This presents a more holistic model of trade finance compared to SCF. By leveraging Falcon to pay early and hold inventory, buyers also get the additional benefit of reducing their unit purchase cost. This means Falcon generates value where other programs create a cost. As specialists, Falcon can provide vendor-managed inventory (“VMI”) and consignment-type services more cheaply than suppliers.

Another advantage of Falcon’s solution is removing the potential tension between suppliers and buyers caused by the burden of inventory ownership. In doing so, neither party has to assume the additional cost of holding inventory while buyers can still enjoy the benefits of increased supply chain security. Falcon is forging a new path for working capital efficiency and supply chain resilience. Are you ready to join us?

This article has been prepared solely for information purposes and the opinions expressed and set out herein are illustrative only. Please note that any content in this article is based upon Falcon’s own views and opinions and should not be relied upon by the reader as advice. Falcon shall not be liable for losses arising out of reliance on this article.