Geopolitical tension and supply chains: Falcon’s alternative to stockpiling inventory

Covid upended global norms but just as the pandemic seemed to be receding we were hit by a man-made catastrophe which is still ongoing: the war in Ukraine.

Russia’s invasion of eastern Ukraine has wrought untold human misery but the impact on the global economy is also proving acute. In particular, the impact of soaring fuel and energy costs is keenly felt, and Russian gas export restrictions do not augur well for the colder months ahead.

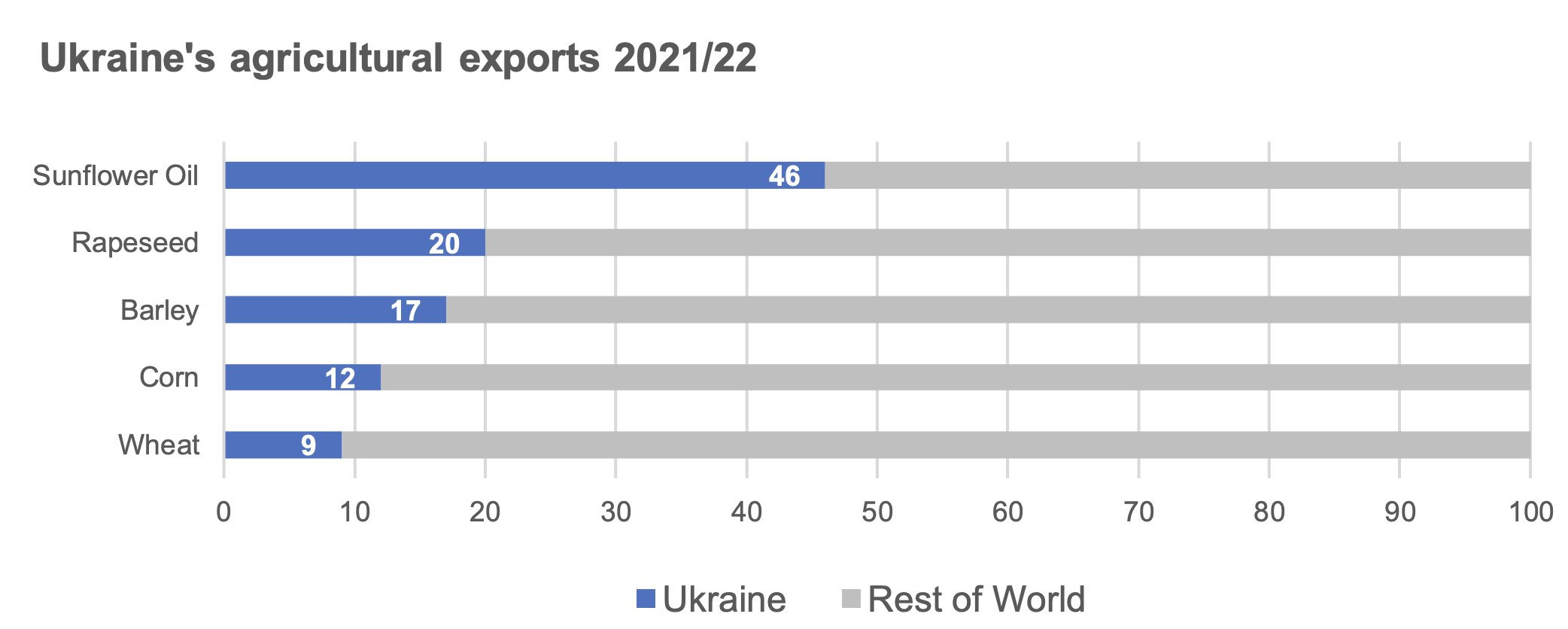

Perhaps less well publicised is the massive reliance on Russian and Ukrainian agricultural exports. According to the UN’s Food and Agriculture Organisation, Russia and Ukraine account for more than 25% of the global trade in wheat, more than 60% of sunflower oil and 30% of global barley exports. The wheat shortage is particularly felt in North Africa, the Middle East, and Asia. Egypt imports 14% of its wheat from Ukraine, with the figure being 28% for Malaysia and Indonesia and 21% for Bangladesh. Countries already impoverished by conflict such as Libya and Yemen are also highly vulnerable, importing 22% and 43% of their wheat from Ukraine respectively.

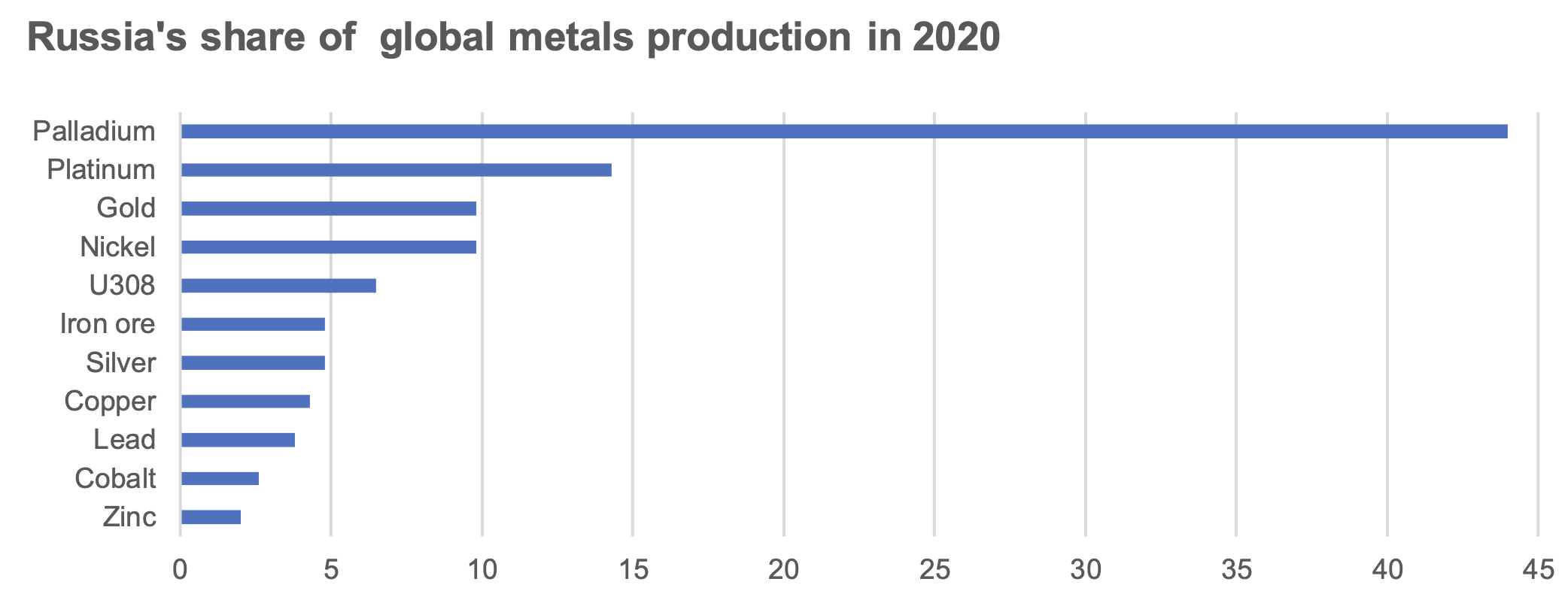

It gets worse. Sanctions-hit Russia is also a leading source of minerals deemed critical to key industries and security interests. The world’s largest country accounts for 13% of the global supply of titanium, 11% of nickel and 30% of platinum-group elements, including palladium which is a key component of catalytic converters. Unfortunately, such sought-after minerals already have an unhelpful tendency to be located in some of the world’s more challenging operating environments. For example, two-thirds of the global supply of cobalt is mined in the Democratic Republic of Congo, where concerns over child labour and workers’ health are well documented. The fact that China now accounts for 85% of the world’s rare earth metals and two-thirds of scarce metals and minerals is also far from ideal for the West.

Geopolitical tensions are therefore a major driver of supply chain vulnerability. This is compounded by the lack of visibility beyond tier one suppliers.

The stock response to supply chain disruption is, of course, building up buffer stock yourself on a Just In Case basis, or better still insisting on this from your suppliers. This inevitably comes at a cost, but the trapped capital, prospect of low-margin clearance sales, and the risk of obsolescence which Just In Case brings are deemed acceptable because, even though owning and storing goods can be a headache, ready access to inventory is assured.

Is there an alternative that provides the supply chain security you crave whilst avoiding the asset-heavy balance sheets of Just in Case? Fortunately, Falcon Group offers a third way between Just in Time and Just in Case.

In its simplest form, Falcon’s model means it can buy new inventory and then sell it back when needed on a JIT basis. In the meantime, inventory is held in the customer’s own warehouse or in a geographically relevant third-party facility, with Falcon holding inventory on its books until required. This liberates trapped capital but also fosters more agile supply. Our solutions can help mitigate the supply chain disruption wrought by geopolitical tension and avoid the trapped capital caused by stockpiling buffer stock.

Please contact our team to learn more.

USA – Bob Belshaw at [email protected]

EMEA – Kevin Cummings at [email protected]

APAC – Krishnan Sankar at [email protected]

This article has been prepared solely for information purposes and the opinions expressed and set out herein are illustrative only. Please note that any content in this article is based upon Falcon’s own views and opinions and should not be relied upon by the reader as advice. Falcon shall not be liable for losses arising out of reliance on this article.